Most smallholder women farmers in Kenya have limited or no access to land, labor, inputs, or credit. Financial institutions often charge high-interest rates and require collateral for credit. Women are unable to provide collateral because they may not have legal ownership of the assets.

To address this, We Effect supports Baringo Agricultural Marketing Services Cooperative Society Limited (BAMSCOS) to empower women socially and economically by establishing Village Savings and Loan Associations (VSLAs) in their union that incorporates 21 affiliate primary co-operatives societies.

The VSLA groups act as self-help platforms to help groups raise funds at the community level without resorting to external lenders. The registered membership in the affiliate organisations stands at 17,000 members; 13,194 are active members, with 30% being women.

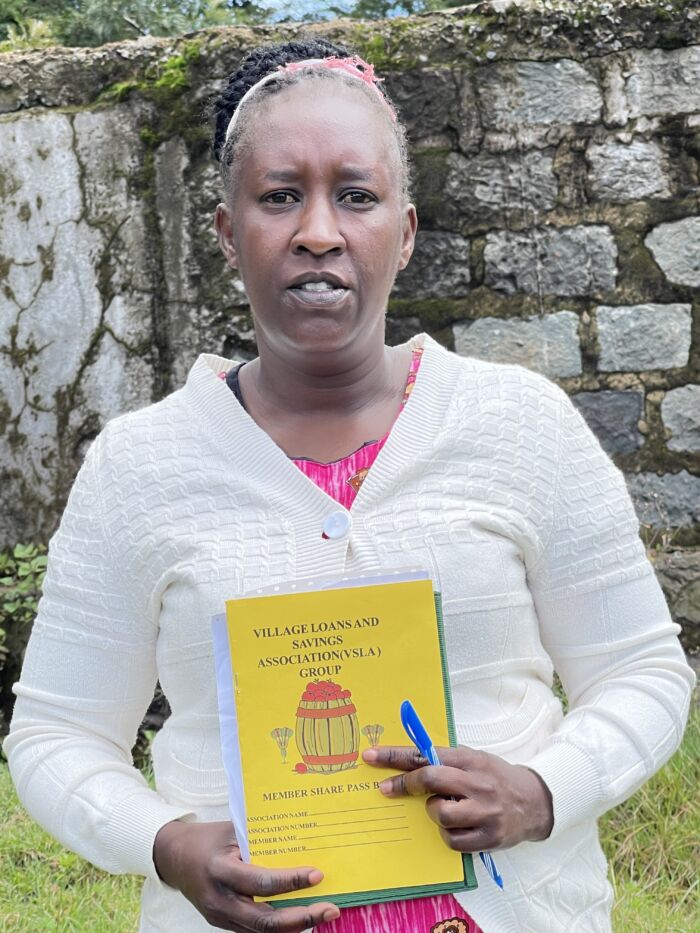

Rhoda Chumba’s experience with VSLAs

Most women lack collateral to access affordable financial services from micro-financial institutions, especially SACCOs. The association members determine the share price at the beginning of the cycle. Members can then borrow from the VSLA using their savings as collateral without necessarily having to sell their property or crops at a cheap price in times of need or emergencies.

Saving has been very empowering. “I sometimes remember back, during planting seasons, I would not have money to buy fertilizer, resulting in always borrowing from friends and family. I survived on debt, always buying farm inputs on credit. My kids were constantly sent away from school. Unfortunately, these short-term loans always came with frustrations and denial. Failure to pay back the loan in time led to additional embarrassment or confiscation of property, animals, or crops.

I can now borrow to buy farm inputs, plant my potatoes, and repay after three months. Additionally, I have managed to buy animal feeds and 50 chicks. Poultry is a significant contribution to women’s empowerment. Chickens are a good investment since they are easy and inexpensive to take care of.

Rhoda and other ladies in the VSLA group raise chickens to diversify their incomes, alleviate food insecurity, and access fast cash when unexpected costs appear. When she sells her chickens, she reinvests the profits in the family.

Recently, one of Rhoda’s children joined high school, the admission process required a considerable amount of money. Luckily, she borrowed from the group and has an opportunity to borrow monthly for school fees.

Farming has been and remains the main source of income. However, the negative impact of climate change on farms and livestock has affected income sources. If there is no harvest due to the changing weather patterns, farmers must adopt new ways of farming. Specifically, Rhoda has adopted irrigation to farm during the dry season. Through VSLA, she bought a water pump that is helping her to farm potatoes, cabbages, onions, and maize at all seasons despite the changing weather.

Lydia Kimaru, an assistant manager with Torongo FCS, explains that establishing VSLA groups ensure that women are empowered financially and are adding value to their households. By saving in a group, members can get quick access to a more significant amount of pooled than they would if they saved on their own.

They now contribute to educating their children since it’s easier to access money from the VSLA than from the banks requiring collateral. Some homes that did not own a cow are now proud owners of a herd.

“The group meetings serve as a means of social engagement in their communities,” she adds.

Sylvia Korir’s story of Transformation Through Savings

38-year-old Sylvia Korir is a dairy farmer with Torongo Farmers’ Cooperative Society, a primary co-operative under Baringo Agricultural Marketing Services Cooperative Society Limited (BAMSCOS). She is a member of a Village Savings and Loans Association Group (VSLA) that saves weekly. After a We Effect-supported training, the 21 all-women member group united to empower themselves financially. They were taught how to save, poultry farming, dairy cow management, and animal feeding.

Based on the respective group by-laws, members buy shares and make regular savings to a common fund from which they borrow at a minimal interest rate. The group has a metal cash box containing a ledger book where transactions are recorded, and savings book for each member. The box has three locks and three different group members keep the keys while the fourth keeps the box. Sylvia also serves as the box keeper. This ensures no one can get into the box easily.

“Alone, you can’t save, she says. I have managed to pay for school fees, buy poultry, farm inputs such as fertilizer and animal feeds for my cows”. With nostalgia, she recalls that “Before, I was not saving anything or anywhere; I would rear chicken and consume them all together with the eggs. I now look at my farm as a business, looking for any available opportunity to save and invest back in the farm. VSLA provides the financing I need to make the business of farming productive.” The loan also keeps them busy on the farm to ensure they are able to repay.

“I religiously save Ksh 100/= weekly, enabling me to borrow when I need money. The feather on the cap is that members also receive their share out at the end of the saving cycle. Last year, I received Ksh 26,500/= explaining with a grin. This was a lump sum amount of money that I have never received at once.”

Sylvia is one of the thousands of members whose lives have been transformed by Village Savings and Loans Associations. This means that Sylvia puts a lot of effort into the farm knowing well that, if you tickle the earth with a hoe she laughs with a harvest.

BAMSCOS has waged a concerted campaign at all affiliates’ levels to embrace the crucial need to promote women’s participation in cooperative enterprises and provide a level-playing ground in financial inclusion. It is promoting dual membership in co-operatives where both spouses are members individually, which is considered vital towards women empowerment.